Why Compare Gemini vs Coinbase in 2023?

You want to make sure that you use a legal exchange when buying and selling Bitcoin. There have been so many users burned by exit fraud and hacks. Coinbase, Gemini, has gained more reputation when JP Morgan has recently announced that they will offer financial services to the two biggest US cryptocurrency exchanges.

Their recognition by such a big bank is a major move toward the widespread acceptance and implementation of cryptography, now two of the best-known trading firms in the world. The key concern of the two exchanges is compliance, but we can see how their policies vary greatly from one another.

Keep reading to learn about Coinbase and Gemini for an in-depth, Coinbase vs Gemini comprehensive comparison.

Gemini

The Winklevoss twins that you can recall from The Social Network formed Gemini in2015 (2010). Twins of Cameron and Tyler Winklevoss have traded heavily in Bitcoin, including several other companies since their $65 million deal with Facebook. The company claimed to own 1% of the circulating supply, which today is more than $1 billion.

The Winklevoss’s way to continue to play a part in the future of the technology is the Wini – which is a Latin term for “twin.” The exchange works today in 49 US and Washington DC, Puerto Rico, as well as in 43 foreign countries.

Gemini has built for itself, ever-shifting in the crypt environment, a permanent location since its arrival. It is not the biggest exchange in Nomics – 17 per volume – but has gained a reputation as one of the best and most credible.

The first-ever Bitcoin Terminal Treaty in collaboration with Gemini was introduced in 2017 by the Chicago Board Options Exchange (CBOE), the biggest foreign exchange of options. The New York State Department also entirely regulates them.

Coinbase

Brian Armstrong and Fred Ehrsam founded Coinbase as one of the oldest and continuously running exchanges in 2012. Since then, Ehrsam has passed onto other ventures and left Armstrong with the public face. In 2014, Coinbase crossed 1 million users and is said to have hit over 13 million since then.

In 2017, Coinbase was issued BitLicense for legal trading between BitCoin and Ethereum in the state of New York by the New York State Department for Financial Services (NYS).

Coinbase provides many options for fast and convenient purchasing and sale of different cryptocurrencies. It supports no nonsense in getting people used to cryptocurrency trading, purchasing and selling. There’s not a lot of Coinbase pages.

Most of the systems are more mature. Coinbase, therefore, has a special business position. Coinbase is synonymous with an advanced network. The GDAX Exchange is more similar to Gemini and other exchanges. GDAX provides more specialised options for ordering and sale.

This includes “limit orders,” “market orders” and the option to fix the order price and leave it and see if it is met for a period of time. This makes GDAX more fitting for traders or experienced users.

The lack of these sophisticated Coinbase options makes it ideal for beginners. After you know about purchasing a Coinbase cryptocurrency, setting up a GDAX account is quick if you want to start trading more frequently. You basically have to search for your business identity.

Coinbase Pro

Coinbase Pro seems to be quite basic, though Coinbase can be very daunting. The important thing is that Coinbase Pro is quite simple. But all company activities are carried out on the Coinbase Pro motor and Coinbase pays far greater payments for the simplistic GUI.

Is the Gemini Exchange Legit?

Which Coins Can You Buy at Gemini?

Only Bitcoin and Ethereum endorse the Gemini exchange. This is presumably because Gemini strives to be a trustworthy and institutional exchange. A lot younger cryptocurrencies would also show over a sufficiently long time which will make the blockchain less sophisticated and mature if Gemini were forced to lose an item, for whatever reason.

Which Deposit Methods are Accepted at Gemini?

Gemini embraces deposits made in the US and wire transfers elsewhere via ACH (automated cleaning housing). It accepts Bitcoin and Ether deposits as well. No other types of deposit are approved at present.

Update 2020: In addition to a number of digital assets such as BTC, ETE, LTC, BCH, BAT, Connect and other, Gemini now accepts Fiat currency (USD).

Account Verification

As the Gemini trading site is in compliance with current rules, a personal account must be checked. Three steps are taken to validate your identity: connect a two-factor authentication cell phone number, link a bank account, and eventually upload documents for confirming your address and ID.

What’s Better? Coinbase or Robinhood?

Robinhood and Coinbase are two of the most common locations for casual traders. Both are easy to use but have major variations.

Deposits and Withdrawals

Robinhood would be fine for you if you just want to work with USD. If you choose to finance or purchase bitcoin from your account to your private wallet or another trading site, Coinbase is a safer alternative. But. That is the most critical choice.

Trading Cost

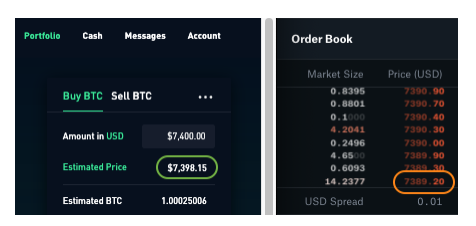

It’s all about the highest all-in deal for most traders. Here are the two sides (Left Robinhood, Coinbase, right). First of all, Coinbase seems cheaper because the price on the screen is about $9 (0,12 per cent) lower than that on Robinhood (7389.20 vs. 7398.15). However, payments have to be weighed.

Trading in Robinhoods is easy, while the fee schedule in it is dependent on the amount of trade. The 0.50 per cent charge for most small traders (in this case $37) is clearly more costly for Coinbase’s net if you do not trade more than $50 million a month, Robinhood would be less costly. For the majority of people, Robinhood is thus a safer choice.

Transparency

Coinbase is an exchange which matches or allows orders to be placed directly between purchase and seller. In real-time and is typically $0.01 wide, the complete order book is shown. The fee calendar is also explicitly illustrated on the website, but your net selling price can be difficult to determine. By showing a trading price without extra costs, Robinhood makes it simpler.

However, Robinhood is just a broker and offers orders to trading houses, so the price differential is mostly $20. There’s a big markup, but there’s no tax. There are no other orders and commercial prices. While overall trading costs for Coinbase’s are higher, the platform is more open in market orders and trading and straightforward with regard to actual trading charges (or markup).

Trading Tools

It is simply possible to change from the demand to the limit order, but Robinhood has Buy and Sell keys. They have a price map that is both set and unknown. But that is about it. Coinbase is a little more with a more “stop” order and a lot of information about the real-time market exchange in the form of a transaction book, industry history and a configurable chart guide.

Both sites are ultimately short of conventional online trading platforms like E*Trade, ThinkorSwim and Virtual Brokers and cannot rely on valuable trade resources more successful traders would like or predict.

Cryptocurrencies Beyond Bitcoin

Let’s compare available items for USD trading. Robinhood has seven, and Coinbase Pro sells seventeen. Please see the comparison head-to-head below.

However, Coinbase lists even cryptocurrencies priced in Stablecoins and also other cryptocurrencies, but for those who wish to step outside fiat currency like USD, there is a tonne of versatility.

How Much Does Gemini Charge to Buy Bitcoin?

What are the Gemini fees?

Any of the above-mentioned payment options are absolutely free of charge. The movement of cables from the bank from which the money is sent may therefore be subject to payments. Additionally, consumers must pay a Gemini Bitcoin or Gemini Ethereum deposit fee for network deposits.

But that’s the same as exchanging every digital currency network. Women’s rates vary slightly from those on other digital asset trading sites.

It depends on the amount of your market for 30 days. Six types of fees are available. This varies from light traders to Bitcoin and Ether traders. Fees will be recalculated for all trading pairs every day at midnight UTC.

The table below provides a summary at each level:

How fast will my funds be available?

Does Gemini Have a Wallet?

If an external bitcoin or ethereal wallet is required

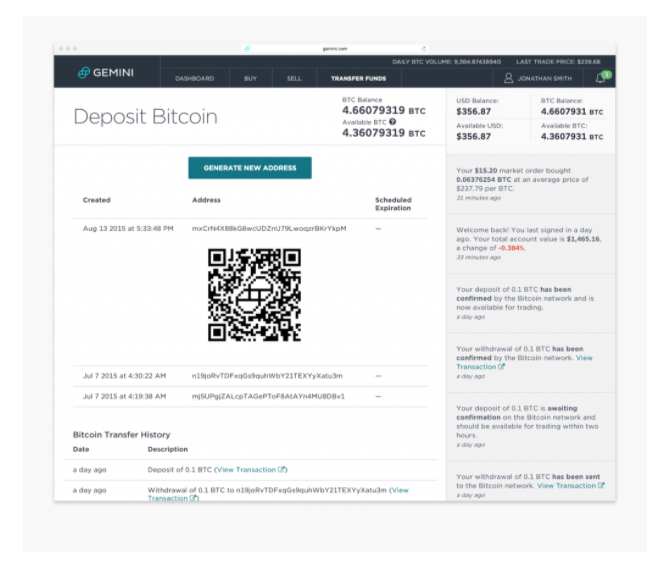

It’s the same convenient method for all cryptocurrencies and you can deposit either Bitcoin or Ether in your Gemini account. Just pick BTC or ETH deposit and they will produce an address to deposit for you.

You should easily trigger a switch from your external wallet and check the QR code you get from them if you have an ether or bitcoin wallet on your mobile device. You should copy the Bitcoin or Ethereum address when your external wallet will ask you to submit your digital currents if you do not have a mobile device.

You have to move it from your external pocket, not from the end of Gemini. Yeah, and Gemini charges zero or termination fees! In the retirement process, it is also simple. Just select Remove BTC or Remove ETH and enter the address of your external wallet to complete the transition.

Note: each account with a wallet arrives with your money deposited on the exchange. You should save your money.

It varies from an external pack, a safer location in which your cryptocurrency can be kept. The wisest investors in the crypto-money habit of storing their coins as much as possible in an external wallet and keeping them in the bag only when they are engaged in an aggressive trade. You will start trading until your Gemini account is funded.

Gemini vs Coinbase

There is no shortage of choices for beginners finding a place to shop cryptocurrencies such as Bitcoin and Ethereum. Coinbase vs Gemini, the two most widely and fairly preferred alternatives. These days, there are several different ways to acquire digital currencies.

The multiple choices will make it hard to choose which service to use. You want to know, of course, that your money is safe.

This is why we are going through two very famous exchanges in this Coinbase VS Gemini contrast. In order to give you the truthful contrast between two of the biggest and most trusted exchanges in the cryptocurrency industry, I have prepared this Coinbase VS Gemini.

After reading it, you should know if you have a bit of the history, the different functionalities, the prices they charge, the various digital assets that you can purchase from them, the Gemini and Coinbase security features, and the number of digital currencies that each exchange trade offers.

In this overview “Coinbase vs Gemini,” we will show you the distinctions between the two choices, so you can make the most educated decision.

Is Gemini More Trustworthy Than Coinbase?

Both businesses are located in the United States and represent American customers. This means that both enterprises are controlled by separate United States government and regulatory authorities. In 2012, Coinbase began. In this time, they represented 8 million consumers and traded digital currencies for more than $20 billion.

The investment was also obtained from Alexis Ohanian (Reddit Co-Founder), Blockchain Money and the Bank of Tokyo. Gemini was founded by the Winklevoss twins in 2015. While they haven’t been around as long as Coinbase, the group rapidly has built up a reputation. They always have the highest amount of Bitcoin trade in all markets every day.

Comparing Purchasing Limits

Coinbase does not set explicitly restrictions for potential users on its website. The caps can instead differ based on age, history of purchasing and account checks. On your account verification tab, your personal limits will be shown.

In our experience, we have easily set bank transfer limits at $5,000 a week, although originally credit card limits were just $60 a week. Gemini also set bank transactions to purchase caps of $500 monthly. If you try to lock up a price of over $500 at once, Coinbase would presumably give you more limits. Both platforms offer wire transfers, but you will have to explicitly apply or email people seeking to pay greater amounts.

Safety of Funds

Both sites distinguish client funds from operating funds of the organisation. In addition, both platforms have the best practices in the field to protect crypto-monetary funds. Most cryptocurrency funds are deposited in safe cold storage wallets.

Customer Support

Although customer service is a challenge for many cryptocurrency firms, both Coinbase and Gemini do a decent job here. Customer support for Coinbase is managed by email. We have always obtained answers within 24-48 hours in our personal experience.

This is mirrored in the bulk of posts from online sites, though the time periods could be 24-72 hours. Gemini also operates its customer service through e-mail. Answer times sound like Coinbase pretty much.

Available Cryptocurrencies

Coinbase allows Bitcoin, Ethereum, and Litecoin to be purchased and sold. Gemini funds Bitcoin and Ethereum exchange only.

Fees

Gemini is your best bet if your goal is to save as many fees as you can. They charge no reservation or cancellation fees and only a 25% or less trading fee. Coinbase charges about 1.49% for sales of bank cards and 3.99% for purchases using a credit card or debit card.

Which Offers Better Security?

Coinbase and Gemini now have separate additional protection actions in order to secure the money and cryptocurrency of consumers. First of all, they distinguish the income of their clients from the money that the businesses must use.

Two-factor authentication is also applied by Coinbase and Gemini. This greatly lowers the risk of publishing or hacking an account. In this case, two-factor authentication allows users to use a password and a cell phone to access their account. When trying to log in, you send a message with a code to your cell phone. This code must be enforced.

There are a host of other authentication features in both exchanges. Here is a complete and thorough overview of Coinbase VS Gemini:

Coinbase Security Features:

On hardware which is absolutely isolated from the Internet, sensible data are processed. The data is divided between encrypted USB drives and paper copies in numerous geographical areas worldwide.

All site data runs via SSL-HTTPS encrypted. The AES-256 encoding for securing wallets and private keys are used.

Gemini Security Features:

Amazon Web Services secures the only digital riches that are saved online in a “hot wallet.” AWS’s high standard of security checks is well established.

Only high-level workers can handle hot wallet coins.

The hot wallet has to be accessed by multi-factor authentication (a more sophisticated form of two-factor authorship).

Hot and cold baggage keys are protected by high-quality access controls on hardware.

The defence for them is improved by two layers of cold storage.

Surveillance hardware comes from various suppliers to avoid supply chain problems.

Cold storage access allows more than one employee to work concurrently.

Exchange of full reserve. The money of consumers is kept apart from the corporation and is often in an insured bank of the FDIC.

Every confidential account information is encrypted.

Data is transmitted via Website via encrypted Transport Layer Safety links such as HTTPS.

You can also see that both exchanges take protection precautions very seriously while you don’t grasp all these protections. Gemini uses therefore much more drastic measures to protect assets. This is presumably why, when the Gemini exchanges began in December 2017, they wanted to redeem Chicago Board’s Bitcoin Exchange options futures.

Gemini is possibly the most appropriate choice for those who need to professionally store vast quantities of crypto-monetary exchange for trading since it provides consumers with certain high-security protections. However, it is important to understand that places such as Gemini and Coinbase are not ideal for long-term storage.

Which Exchange Offers Which Deposit Methods?

Coinbase and Gemini provide various funding options for consumers. However, Coinbase’s are considerably more extensive. At Coinbase, customers can purchase a credit card or debit card or bank transfer to their cryptocurrency.

Gemini’s digital properties can only be acquired through bank transfers. Coinbase obviously has the advantage when depositing methods in Gemini VS Coinbase.

Aside from purchasing using a credit card or debit card, you have to know that any cryptocurrency funded by any exchange can also be used as a deposit. Withdrawals should be rendered using both the same techniques as deposits.

Gemini vs Coinbase: Which Exchange has a Higher Trading Volume?

Coinbase’s users buy and sell much more Bitcoin than Gemini. This is presumably because, due to its user-friendly choices, most people buy and sell Coinbase in Coinbase for themselves. Those that buy and sell can spread through a wide range of different exchanges according to their personal interests.

Coinbase has traded BTC 5,15 million in the last six months since its written date (May 2018). This gives Bitfinex a market share second only. According to data.bitcoinity.org the aggregate market share of Coinbase currently stands at 15.3%. In the meantime, Gemini only traded BTC 1,54 million during the same period. This gives it a 4.57 per cent market share.

Which is better?

The war of Coinbase versus Gemini is focused on both websites’ trustworthiness and security to your needs. You have Coinbase as an option if you want to buy cryptocurrencies easily or if you want to use your credit card.

Gemini is the perfect choice if you want to save the most on payments.

Conclusion

There are now two famous cryptocurrency exchange options that you can know even more about. I addressed all facets of these two platforms: protection, costs, volume, the supply of coins that each country can use as well as customer service. This should give you an idea, which one you should pick if you are stuck!

Coinbase is generally the most recommended cryptocurrency exchange for brand new users who have never traded an asset before. The interface is very user-friendly and it is worth it even though the payments are a little more. In the meantime, Gemini undoubtedly makes a better Coinbase option for those who take digital assets more seriously than saving.

With over 10 years of experience working as a financial analyst, Eric is highly aware of the potential of cryptocurrency, particularly Bitcoin, and the impact it will bring towards the global economy. He is committed to share everything he knows about crypto here at Crypto Digest News.