San Francisco based Kraken has been operating since 2011 and is widely considered to be among the top cryptocurrency exchanges in the world. It is one of the most secure exchanges out there as this cryptocurrency exchange provides a comprehensive range of safety measures, self regulated approach and security audits.

As Kraken itself boasts, the exchange is ‘consistently rated the best and most secure crypto exchange by independent news media’.

While determining the best crypto exchange out there is very subjective, it is certainly the case that Kraken is among those widely considered as the most sophisticated, reputable and secure by participants and traders of cryptocurrency markets.

Trading Features

Another big plus is that Kraken fees are among the lowest in the industry, with free deposits and very competitive withdrawals and trades. Additionally you are able to trade on the go if you have a Kraken Account using its web platform or one of its mobile apps.

Kraken has the highest euro volume of Bitcoin trading among all the cryptocurrency exchanges that are out there and is consistently within the top tier crypto exchange international for both buying and selling Bitcoin and trading volume across all cryptocurrencies supported. Kraken is one of the first crypto exchanges to have its trading volumes and prices incorporated into the Bloomberg terminal.

Kraken offers an exhaustive range of different trading options that range from placing the usual limited orders and stop-loss orders to margin trading and dark pool. Kraken is a trading platform that enables trades not only between cryptocurrency pairs but also between fiat currencies (Canadian dollars, US Dollars), so it is an excellent fiat to crypto gateway.

During its time on the crypto exchange market, Kraken has made a name for the following features:

- Fiat-To-Crypto onramp with high liquidity. Kraken allows you to trade with more than 32 different kinds of cryptocurrencies in more than 140 markets with 6 different fiat currencies. USD,EUR,CAD,JPY,GBP and CHF.

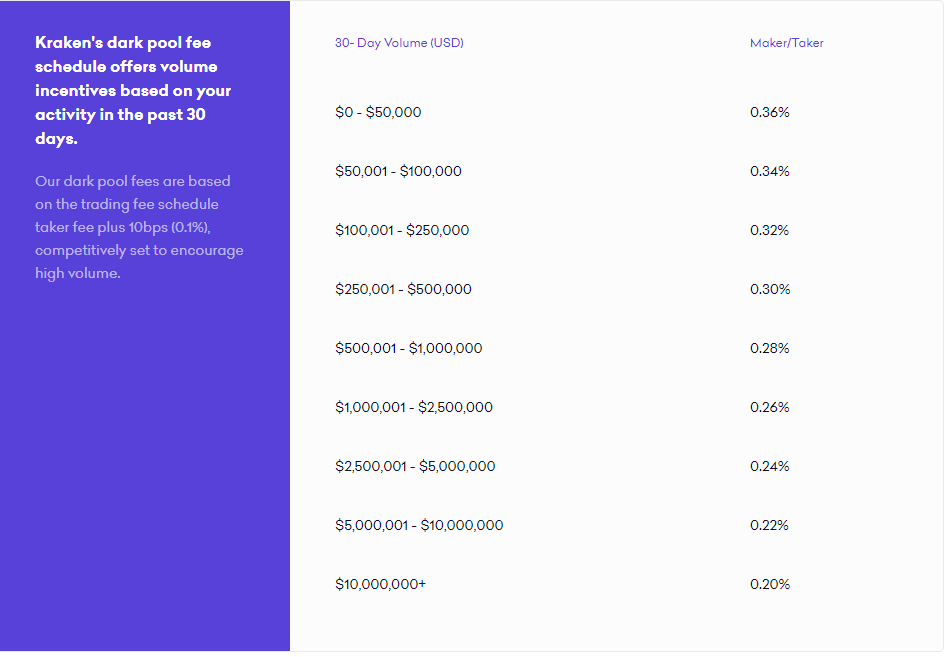

- Dark Pool. Kraken is a cryptocurrency exchange that offers an invisible order book, otherwise known as a dark pool. Each trader will only know his orders and can trade anonymously without revealing their interest to other traders.Kraken’s OTC Service. A trader who consistently trades with high volume can use

- Kraken’s OTC with a one on one service.

- 24/7 Customer support desk. Kraken offers 24/7 global customer support chat in case its users have any queries which require assistance.

- Margin and futures trading. The Kraken cryptocurrency exchange offers margin trading of up to 5x leverage

- Forex Trading. Using Kraken, you are able to exchange your fiat currency into one of six other supported fiat currencies.

- Secure and trustworthy platform. Kraken is an industry leader when you are talking about crypto security as Kraken has never been hacked before so you can be sure that your funds are safe when left in the exchange’s custody.

As well as Bitcoin trading, other cryptocurrencies supported by Kraken are:

Ethereum (ETH), Bitcoin Cash (BCH), Monero (XMR), Dash (DASH), Litecoin (LTC), Ripple (XRP), Stellar/Lumens (XLM), Ethereum Classic (ETC), Augur REP tokens (REP), ICONOMI (ICN), Melon (MLN), Zcash (ZEC), Dogecoin (XDG), Tether (USDT), Gnosis (GNO), and EOS (EOS).

In terms of the actual trading software where buyers and traders are able to make transactions, Kraken has been considered good but not without room for improvement. As with all other cryptocurrency exchanges, Kraken has been known to encounter server problems when traffic and order volumes peak.

However, Kraken has recently released a full update to its trading platform which is expected to improve both its usability,smoothness and solve the issue of website crashes at peak trading times.

In addition to the usual standard trading platform of buying and selling cryptocurrencies, KRaken also offers experienced traders such as margin trading with up to 5x leverage and an option to take a short position.

Kraken strives to add value-added market data and trading tools to its platform, often through various acquisitions, such as 2019’s purchase of live cryptocurrency price streams and Cryptowatch, which is a charting specialist.

All in all, Kraken is an old Digital assets exchange for traders looking for fiat on and off-ramp, as Kraken comes with a variety of features and advanced trading options for every seasoned trader as well as simple trading options for crypto enthusiasts who are new to the crypto scene.

Exchange History and Background

Founded in 2011 by early crypto pioneer, Jesse Powell and launched in 2013. It has since then become one of the most reputable exchanges in the industry. Based in San Francisco, United States, Kraken is a fully regulated exchange, meaning that Kraken ensures its high volume traders pass Know Your Customer (KYC) checks in order to trade.

Besides, among all the crypto exchanges out there, it has the privilege to be chosen by the Tokyo District Court to handle customer compensation claims related to the infamous collapse of Mt. Gox in 2014.

During its many years of operations, Kraken has built a solid reputation as a secure exchange and popular choice among traders and institutional investors. It’s one of the first crypto exchanges to pass the Proof-Of-Reserves cryptographic audit and provides crypto market price information to Bloomberg Terminal.

The Kraken exchange is self regulated and complied with rules and regulations in all of the jurisdictions it supports. The Kraken exchange is also registered as a Money Service Business (MSBN) with FinCEN in the United States (Registration Number 31000136371793) and FINTRAC in Canada (Registration Number M19343731). In the United Kingdom, the Financial Conduct Authority regulated the Kraken Futures (Registration Number 757895).

The exchange’s headquarters are in San Francisco, but it has offices in various cities all over the globe, including New York, London in the UK, Chiyoda City in Japan and Singapore. Kraken exchange has received more than USD 126 million in venture capital according to Craft.Co.

Because of this, it has acquired a number of crypto-oriented startups like CryptoWatch, CleverCoin, Coinsetter, Cavirter, Bit Trade, Crypto Facilities and Interchange.

Kraken’s webpage has all its content in English – even more, you can select between US and British English, whichever best suits your needs. Furthermore, the site is available in eight other languages, including Spanish, French, Italian, Portugese, Russian, Turkish, Chinese, and Japanese (even though Japan is currently not on the supported countries list)

Verification

Kraken’s verification process is pretty straightforward but when it comes to higher-tier verifications, Kraken can be a little strict. In total, there are about four tiers. Tier 1 can take only a few minutes and be performed automatically if everything is submitted correctly. It could potentially take longer if the application requires a manual review.

Tier 2 and 3 verification usually takes a couple of days to complete while Tier 4 which is also known as corporate verification takes currently more than 5 days due to increased demand. One thing to note about Kraken is that they do not allow deposits, withdrawals or trading verification. The below explains how the user’s limits increase with tiers.

Tier 1 (Starter) – With Tier 1, users are only able to perform deposits and withdrawals in digital currencies only. Trading could be performed with both digitals as well as fiat currencies. Getting Tier 1 verification requires a user’s full name, DOB, country of residence and physical address and phone number verification.

Tier 2 (Intermediate) – Deposits, withdrawals and trading in digital currency will be made available. Margin trading is also available for verified accounts. Intermediate verification requires: Valid government ID, recent proof of residence, occupation and a social security number (for US clients)

Tier 3 (Pro) – If you have a Tier 3 Kraken account, fiat deposits and withdrawals are limited to $10M every day and $100m every month. Withdrawals in digital currencies are limited to $10M per day and $300M per month. Tier 3 (pro) Kraken accounts will have no deposit limit for Pro users. Tier 3 verification requires additional KYC questionnaires to be filled out and signed.

Trading Fees

Kraken is one of the cryptocurrency exchanges that reduce its prices drastically in order to keep ahead of the competition and is currently one of the cheapest trading platforms. The exchange charges the following fiat withdrawal fees:

EUR SEPA withdrawal – EEA countries only Euro 0.09

GBP SWIFT Wire Transfer – 0.125% with a $35 minimum fee

USD FedWire – available in the US, $5 flat fee

CAD EFT – Canada only, 0.25%

JPY SWIFT – worldwide, 0.125% with a $35 minimum fee

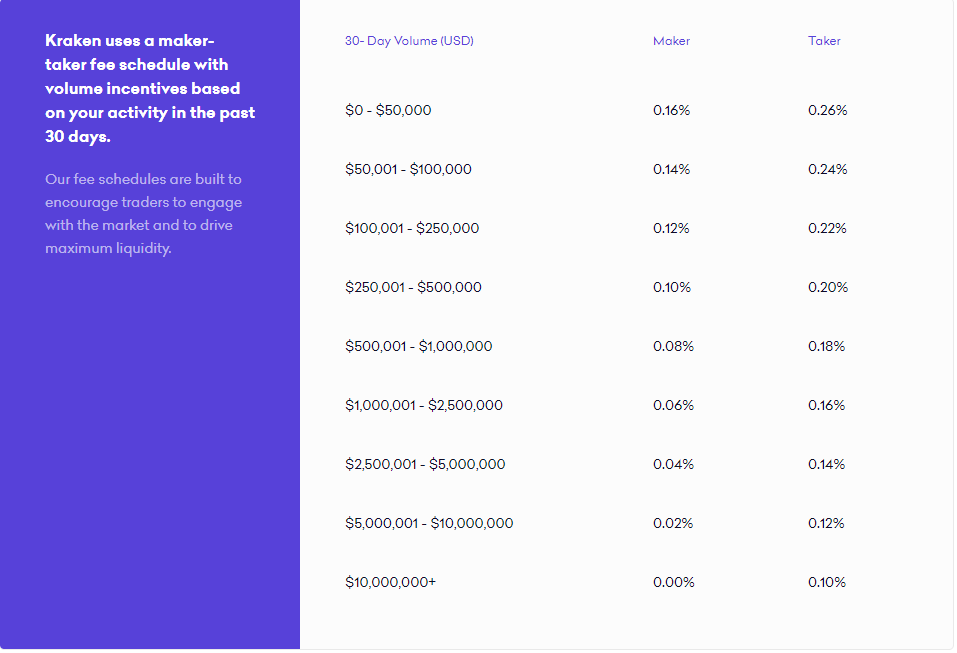

All fees are charged on a per-trade basis, apart from deposit and withdrawal fees, and generally fall into four categories: regular trading fees, stablecoin trading fees, dark pool trading fees and margin trading fees.

Maker & Taker Fees

Kraken fees for deposits are flat for a majority of transfers. ACH and Fedwire cost $5 while SWIFT deposits cost 35 USD /EUR and SEPA transfers are free of charge if sent through FIDOR Bank. Most cryptocurrency deposits performed are free except for smaller, less liquid coins.

Regular trading fees are charged for both the maker and taker, and start at 0.16% for maker and 0.26% for taker. Trading fees percentage will generally decrease as the trading volume increases, and potentially drops all the way to 0.00% for the maker and 0.10% for the taker.

Different fees would apply to trading pairs involving stablecoins. Over here, you pay 0.20% or less based on a 30-day volume per trade regardless of whether you are a taker or maker. THigh volume traders exchanging more than USD 1,000,000 a month in stable coins however do not pay any fees.

Kraken offers Future fees between -0.0020% which is an instant rebate for makers and 0.075% for takers.

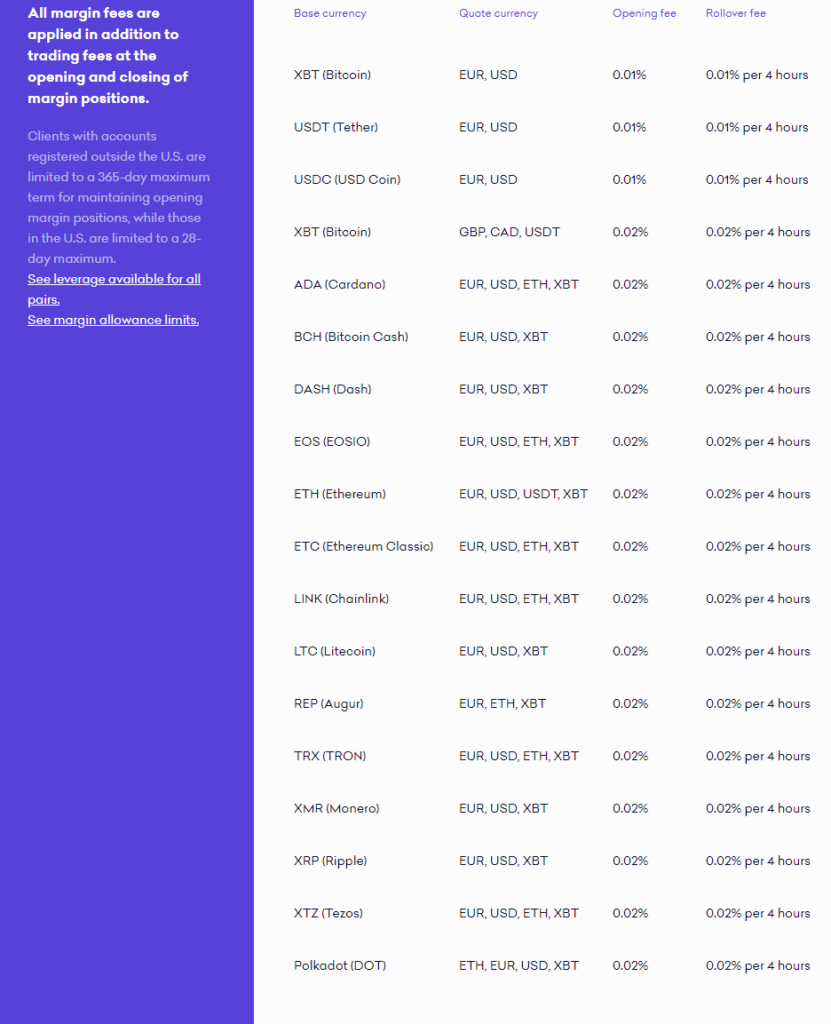

Margin Trading

In terms of margin trading fees, Kraken charges an opening fee of 0.01% to 0.002% and a rollover fee of 0.01%-0.02% after every 4 hours until the leveraged position is open in the trading platform. As such, Kraken charges less than all major margin trading exchanges, though these trades get more expensive the longer your position remains open.

Margin allowance limits on this exchange also depend on your verification level with the maximum leverage available in Kraken being 5x.

Dark Pool

Deposits and Withdrawals

One more category of Kraken fees are under deposits and withdrawals. For deposits, there are no fees charged on this exchange for most cryptocurrencies. For some newer or more uncommon currencies, there will be deposit and wallet set up fees.

Kraken charges a fee for all withdrawals. Compared to other exchanges, Kraken’s aren’t the lowest compared with other exchanges, but they aren’t costly either and it all depends on the cryptocurrency being withdrawn.

For fiat currencies, Kraken also charges a fee for withdrawing them. A standard US wire or bank transfer would cost you 5 USD per transaction while a global SWIFT USD transaction incurs a 35 USD fee.

EUR withdrawal via Sepa bank transfer would cost you about 0.09 EUR, while worldwide SWIFT transfer via Etana custody is priced also at 35 EUR. CAD,GBP, CHY and JPY withdrawals are possible but vary based on the transaction method.

In comparison with other exchanges, Kraken fees are cheaper than Bitstamps at 0.5% per trade but slightly more expensive than Coinbase Pro (0.15% makers and 0.25% takers) and Bitfinex which can boast of having the cheapest order execution fees amongst major fiat-to-crypto exchanges at 0.10% makers, 0.20% takers)

All in all, Kraken appears to offer low fees, and are justified and reasonable. As such, the Kraken exchange falls onto the less expensive end of regulated exchanges.

Trading

Kraken offers less than ten different cryptocurrencies for trading but the exchange offers the option to make direct trades between all available pairs. In total of five fiat currencies, the exchange gives enough trading options for everyone.

Kraken is also the best choice for those who are looking to have maximum control over their trades. Margin trading is not available on all currency pairs but only on the following most liquid altcoins: Augur, Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Monero, Ripple and Tether.

Users are able to trade these coins with margin against the USD and EUR or against Ethereum and Bitcoins. The amount of leverage however, depends on the coin which varies between 2x and 5x.

The Kraken exchange currently introduces futures trading where you can trade on leverage up to 50x. However, Futures Trading is available for verified users only who are outside of the United States. Perpetual futures are available but quoted in USD.

Users can also utilize various order types to manage risk like limit orders, advanced orders with predefined triggers, leveraged positions, margin trading as well as short selling.

Ease of Use

Kraken is software which is highly rated for both experienced and beginner cryptocurrency traders. Their interface offers simple, intermediate and advanced templates assisting beginners to get their bearing and at the same time allowing experienced traders to utilize all the advanced options they require.

The trading platform also provides an official iOS application and an Android application which includes all the necessary features you require to use your Kraken account for trading.

Please note that you need to connect your API key to use the app so you will need to familiarize yourself with the setup instructions prior to installing the app. Kraken Futures platform is currently running in a different application for mobile devices so you can find the app in the play store.

Security

Kraken is probably one of the most secure online cryptocurrency exchanges in the world and security levels are generally considered to be very high. After the Mt Gox collapse, Kraken was one of the first companies to create a cryptographically verified proof of reserves which shows that the exchange holds 100% of customer funds, which it should.

They hold the majority of funds offline in cold storage form and servers are held in secure locations supported by top of the line security guards, retina scanners and top tier video surveillance.

However, Kraken does require high forms of personal identity verification of its account holders in comparison with some of the other cryptocurrency exchanges out there. This is largely connected to whether account holders wish to make deposits or withdraw in fiat currencies as well as cryptocurrencies, as Kraken voluntarily operates in line with general banking standards in this field.

Kraken has also placed security measures to protect funds from being hacked, as such its reputation as an exchange that has never been hacked. Deposits and funds held on account are isolated from all online systems and are themselves protected by security systems such as ‘two- factor authentication’ so no one will be able to log in to a user’s account unless they have access to both the username and passwords.

Security in terms of Kraken’s liquidity is also extremely high with high levels of encryption being used. The exchange maintains full reserves so there is no possibility of a ‘bank run’ compromising liquidity and customer funds are separated as mentioned previously, from operating funds and accounts.

On the topic of two factor authentication, the company uses PGP encryption for email communication and global setting lock which is a mechanism which prevents any account changes in a particular time period. Although Kraken has never been hacked, there are some cases where users got their accounts hacked due to lack of two factor authentication due to carelessness.

Even Though Kraken has top tier security, one thing that happens to a lot of its users is that there are capacity problems when there is a lot of volatility in the market. This is a problem as you will want to react quickly to a market change or you want to buy/sell but the exchange is not responding.

Support

Kraken offers 24/7 customer support via instant email and online chat responses. Kraken however, does not offer any telephone number to be directly contacted as they would like to prevent a scam.

The quality of the support however is rather low rated as it sometimes takes a couple of days to react and forces its users to rely on other means such as one person who took to Reddit in order to get heard.

As such, support is still an area generally considered that Kraken could do most to improve on, with the time required to receive a response the most commonly criticized element. Other than that there are generally no other serious complaints to be had of Kraken.

Since then, Kraken has also opened its own Reddit thread where they try to communicate and try to respond to user queries publicly where applicable.

Additionally, Kraken also runs a unique call back system which allows its users to leave them a message over a ticket on the trading platform and customer support Kraken will call you back on your previously registered phone number.

The hours of operations are between Monday to Friday, from 12:00 to 24:00 UTC time. IT is important to note however, that since phone support is not available, it could be a hassle to get help in case of issues with verification, login or trading and users can only be updated by Kraken with general updates and help related to crypto deposits.

Frequently Asked Questions (FAQ)

Q: Can you buy Bitcoins on Kraken?

Yes you can buy Bitcoins directly on Kraken using bank transfer or bank wire transfers as one of the many payment methods. In order to purchase on Kraken, you will need to verify your account first.

Q:Is Kraken better than Coinbase?

In terms of low fees, Kraken is definitely better than Coinbase as Kraken only charges 0.26% trading fees while Coinbase charges a flat fee of $1.99 +3.99% for transactions with a credit card.

Q: Who owns Kraken?

Kraken is owned by Payward INC., with most of the share owned by Jesse Powell.

Q:Is Kraken good for trading?

Yes, Kraken is an exchange with relatively low fees and currently there are 30+ different trading pairs available on the Kraken exchange.

Q: How do I withdraw Fiat currencies from Kraken?

You can only withdraw money from Kraken using bank transfers on wire transactions. There are a couple of other options such as using ACH and FedWire for supported type of fiat currency. It is good to note that all first-time deposits go through a temporary 72-hour lockdown period and funds can only be withdrawn from the account after that.

With over 10 years of experience working as a financial analyst, Eric is highly aware of the potential of cryptocurrency, particularly Bitcoin, and the impact it will bring towards the global economy. He is committed to share everything he knows about crypto here at Crypto Digest News.