For people who are interested in buying the most popular cryptocurrency with fiat currency, Coinbase is a popular cryptocurrency exchange globally. It was founded in 2012 and based in the United States, and operates in many other countries.

Coinbase has gained more than 13 millions traders and traded more than $150 billion in just a few years. However, do keep in mind that Coinbase is banned in many countries and Coinbase Pro in many more.

Many people get confused between Coinbase and Coinbase Pro. In this article, we are going to talk about the difference between Coinbase and Coinbase Pro.

Coinbase

Coinbase is a simple and easy-to-understand regulated trading platform for buying, selling, storing, and transferring cryptocurrency. However, simple and handy also means that it doesn’t provide as many features as Coinbase Pro.

If you are getting into cryptocurrency for the first time, Coinbase is a good trading platform for you as it is more user friendly. Compared to Coinbase Pro, Coinbase has lesser payment options. You do not get to control your own private keys for your cryptocurrency.

Basically, Coinbase will give you a password. Other than that, Coinbase does not give anonymity to traders. The more you trade, the more you have to pay too, since Coinbase charges 1.49% on transactions made with a bank transfer, and 3.99% for debit or credit card transactions.

Cryptocurrencies that Coinbase Support

There are various of cryptocurrencies supported by Coinbase:

AAVE**; ALGO; ATOM; BAL**; BAND**; BAT; BCH

BNT**; BSV (Send only); BTC; CGLD; COMP**;CVC; DAI; DASH**; DNT**; EOS**; ETC; ETH; FIL; GRT**; KNC; LINK; LRC**; LTC; MANA; MKR**; NMR**; NU; OMG; OXT; REN**; REP**; SNX**; USDC; UMA**; UNI**;WBTC**; XLM; XRP; XTZ**; YFI**; ZEC; ZRX

**Exclude New York

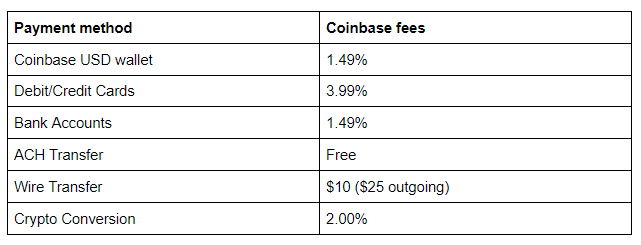

Coinbase fees

Coinbase prices vary across various countries, in this research we will focus on the US. Below is the organized table of the fees.

In addition, Coinbase also charges additional prices on purchases and trades. Coinbase usually charges about 0.50% for cryptocurrencies purchases and sales. However, the instability of the market can make this higher or lower.

Other than that, Coinbase also charges a Coinbase price which is greater than a flat price, or a different percentage of fees determined by regions, product features, and payment types.

Below are the Coinbase Fees examples that Coinbase had given.

- If the total transaction amount is less than or equal to $10, the fee is $0.99 | €0,99 | £0,99 | C$.99

- If the total transaction amount is more than $10 but less than or equal to $25, the fee is $1.49 | €1,49 | £1,49 | C$1.49

- If the total transaction amount is more than $25 but less than or equal to $50, the fee is $1.99 | €1,99 | £1,99 | C$1.99

- If the total transaction amount is more than $50 but less than or equal to $200, the fee is $2.99 | €2,99 | £2,99 | C$2.99

For example, if you wish to purchase $60 of bitcoin and pay with a bank account or Coinbase wallet, the flat fee will be $2.99. As stated on the table above, the variable percentage fee will be 1.49% of the total amount, which makes it $0.89.

Since the flat fee is higher than 1.49% of the total transaction, your fee will be $2.99. If you wish to pay using your Debit or Credit card, Coinbase will charge a fee of 3.99%, which makes it $2.39, since the variable percentage fee is higher than the flat fee.

Security

You are probably wondering, is Coinbase safe? As one of the most well-known cryptocurrency exchanges with more than 10 million users, Coinbase uses a series of excellent safety measures for its account holders.

Although Coinbase itself is secure and has never been hacked, there are still users who had their individual accounts hacked. With this, it is recommended that you store your coin on a crypto wallet rather than Coinbase itself.

Coinbase uses two-step verifications, biometric fingerprints login, will store most of the users’ funds in offline cold storage, and insurance in the event that your Coinbase is accessed by other people.

However, it does not apply if your account is accessed by others due to your own lack of security measures. You have to stay alert and always check your own security measures so your account will never get hacked.

Cryptocurrency is not considered legal tender, therefore it is not backed by SIPC or FDIC. Coinbase provides insurance by combining Coinbase balances and holding them in USD safeguarding accounts, USD designated money market funds, or liquid U.S. Treasuries.

Coinbase provides excellent security measures compared to other famous exchanges.

This is one of the reasons why Coinbase is a good option for those who are looking to get started investing in cryptocurrency without any security issues.

Coinbase Pro

While Coinbase is simple and handy to use, suitable for those who are interested to start investing in cryptocurrencies, there is another advanced and professional trading platform.

It is also known as Coinbase Pro (also formerly known as GDAX), it is a cryptocurrency exchange that leans towards professional and customary investors.

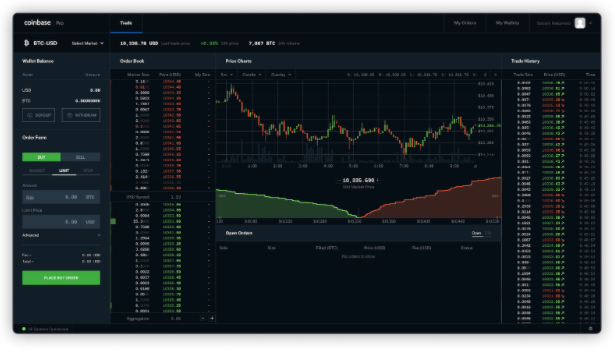

It has more information, better functionality, and also charges less than Coinbase. If you are using Coinbase Pro, you can view it as short-term as a one-minute chart and can use overlays like exponential moving averages.

If you are wondering the difference between Coinbase and Coinbase Pro, the latter supports more trading pairs, it has more than 80 trading pairs available. Coinbase Pro is also popular among investors and traders for its lower fees compared to Coinbase.

Coinbase Pro is not available in as many regions as Coinbase is, it is restricted due to local regulations since the trading platform offers many more features. Coinbase Pro is only available in 42 countries.

Coinbase Pro offers various order options to buy and sell cryptocurrency, such as limit orders, stop orders, and market orders. Limit orders is an order to buy or sell at a specific price.

Stop orders are similar to limit order. Stop order is an order to buy or sell a stock once the price of the stock reaches a specified price. Market orders is an order to buy or sell immediately.

Through using limit orders, you can save money on buying and selling fees. This exchange has some of the lowest fees around for the US and European investors (0.5% for taker or maker fees for the $0-10K tier). It is also possible for investors or traders like them to buy cryptocurrencies without paying any fees to Coinbase Pro.

Coinbase Pro has both a website and an app to keep track of your information and statistics. If you are not using the Coinbase Pro app, you will have to use a web browser to log in to your Coinbase Pro account. This is how it would look for you if you are using Coinbase Pro website.

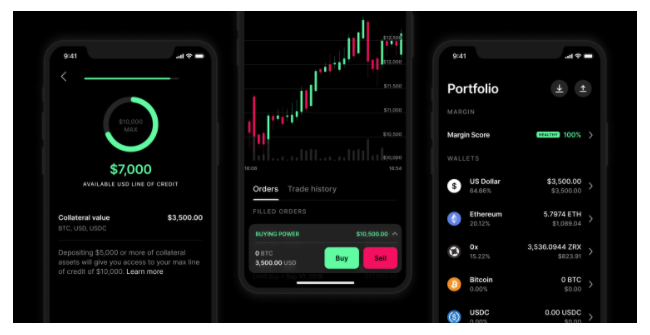

If you are using Coinbase Pro app, this is how the app will look like:

Cryptocurrencies that Coinbase Pro support

The cryptocurrencies that are supported by Coinbase Pro are slightly different from Coinbase. Below are the cryptocurrencies that Coinbase Pro support:

AAVE**; ALGO ✓ **; ATOM; BAL**; BAND**; BAT ✓; BCH; BNT**; BTC; CGLD; COMP**; CVC; DAI ✓; DASH ✓ **; DNT**; EOS ✓ **; ETC ✓; ETH; FIL; GRT; GNT ✓; KNC; LINK ✓; LOOM ✓; LRC**; LTC; MANA; MKR**; NMR**; NU; OMG; OXT; REN**; REP ✓ **; SNX**; USDC; UMA**; UNI**; WBTC**; XLM ✓; XRP ✓; XTZ**; YFI**; ZEC ✓; ZRX

✓ Crypto order book only.

**Exclude New York

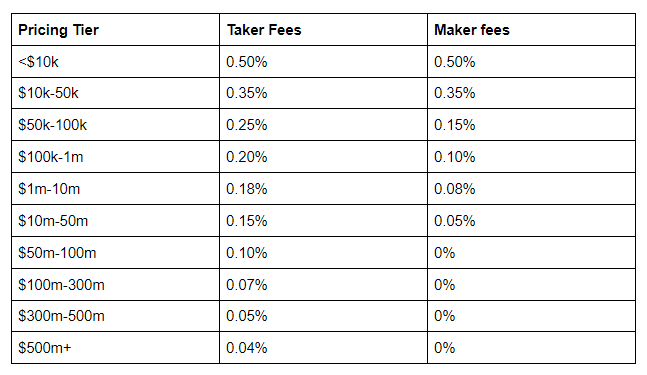

Coinbase Pro fees (Maker and Taker Module)

Coinbase Pro uses a different way to determine the trading fees, which is the maker and taker fees module. Maker and taker fees applied to both buy or sell orders, or a mix of both. Orders that provide liquidity (maker orders) are charged different trading fees than orders that take liquidity (taker orders).

The difference between maker and taker is that a maker adds liquidity to order book, while a taker takes away from it.

When you place an order at the market price that gets filled immediately, you are considered a taker. You will need to pay a price between 0.04% and 0.50%. When you place an order and it did not match any existing order, it will be placed on the order book first.

In the future if another customer places an order that matches yours, you will become the maker, you will have to pay a price between 0% to 0.50% for the remaining portion in the order book. When you place an order but only get partially matched, you only have to pay the taker fee for the matched portion.

The remaining portion will go to the order book. In the future when the remaining portion is matched, you are considered a maker and you will have to pay the maker fee for the remaining portion that was in the order book.

Below is the table for price structure for Coinbase Pro, during our time of this research.

We recommend you to take note that the pricing tiers will take time to update. Do check the price tier for taker and maker before you trade and place an order to make sure you know the current pricing tiers.

API

What are API keys? API is a series of functions and processes allowing the creation of apps that can access the details of an operating system, app, and other more. An API key can be considered as a username that is designed to access data. API keys can make trading or investing easier.

In Coinbase Pro’s case, it allows you to link your account data with other apps such as Crypto Pro portfolio tracker, which is to import your data and view your portfolio statistics.

Trading

Coinbase Pro allows margin trading of up to 3 times on USD pairs. This means you can either long or short cryptocurrencies through accepting a loan from the exchange. Coinbase pro also allows trading between Crypto and Crypto, example of trading pairs is ETH/BTC.

Before your trading, you will have to make bank transfers or SEPA transfers to Coinbase Pro. As for the payment method, bank transactions are available for you, while bank deposits to Coinbase Pro must be sent by ACH which will take between 3-5 business days to come through.

However, SEPA transfers come through within a day. Although you can deposit any amount of money into your account, it still has a limit to withdrawals which starts from $10,000 per day. Coinbase Pro accepts the USD, British Pounds, as well as EUR.

Security

Coinbase Pro has the same security measures as Coinbase. Therefore, Coinbase Pro can be safe too. However, do take note that your account will still get accessed by other people if you do not have stronger security measures and their insurance will not cover that for you.

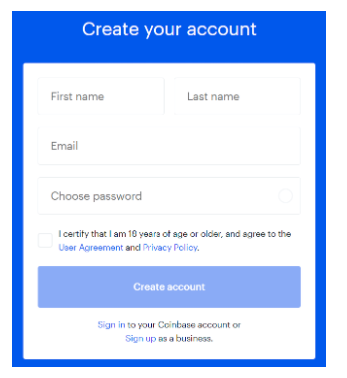

Opening a Coinbase account

If you are signing up for a Coinbase account, it is a very simple and straightforward process. Do keep in mind that you must be over 18. You will have to key in your information such as Name, email, and a password. You are required to verify your email.

After that, Coinbase will need you to key in your personal mobile number so Coinbase could send you the two-step verification codes. Next you will have to enter your identification information.

You are required to prove your identity through state identification just like any other investment account or bank account. A social security number is required if you are in the US.

Till this point, your Coinbase account has already been created and you will be able to add your debit card, credit card, or bank account information to allow deposits and withdrawals so you can start your investment and trading.

How To Buy or Sell Cryptocurrency on Coinbase

After creating an account for yourself, you will have to add your debit or credit card information, bank information, address and ID. The more details you provide, the higher your cap on your buying options. The highest cap for USD is $50,000.

Payment methods can be debit or credit cards, bank accounts, and wire transfer via Paypal. However, do remember that all these options have different fees and processing time. Debit cards, credit cards, and wire transfer are fast which only takes 1-3 days, but with higher price; bank accounts take longer to process which is 4-5 days, but with lower price.

Once you have everything set up on your account, you can choose a coin, your wallet, and the payment method you want to use. After that, you key in how much money you would like to put down and you can check how much of your chosen currency you will get back for it. It is the same method for selling as well.

Common Features Between Coinbase and Coinbase Pro

Coinbase Pro is under Coinbase. If you are wondering if Coinbase Pro charges its users, the answer is no, Coinbase Pro does not charge its users for signing up an account despite having more features. It will only charge you when a trade is made.

You can also use the same information from Coinbase to log in to Coinbase Pro. If you are looking for more advanced trading experience, I would recommend you to use Coinbase Pro. Coinbase is more of a brokerage and also serves as a crypto wallet. It also has lesser payment options compared to Coinbase Pro.

Coinbase is more suitable if you are inexperienced with the crypto market, have no idea how a trading platform works, or if you are thinking of starting to invest as a beginner, as it is more straightforward and user friendly.

You can buy or sell cryptocurrency with fiat currency. While Coinbase Pro is more suitable for you if you are into investing in cryptocurrency seriously. Coinbase Pro requires users to have an idea of how trading works, which might be hard to possess for some people.

Coinbase Pro meets the needs of professional investors and traders who look for advanced trading features. It allows you to buy and sell between other investors, as well as help you save more as you pay less. Coinbase Pro might be too complicated and professional if you are just a beginner.

With over 10 years of experience working as a financial analyst, Eric is highly aware of the potential of cryptocurrency, particularly Bitcoin, and the impact it will bring towards the global economy. He is committed to share everything he knows about crypto here at Crypto Digest News.