Introduction

In South Korea, there is currently a strong opposition from the Korean government and its banks on crypto exchanges. Although this is a fact, South Korea still remains the top cryptocurrency trade exchange markets in the region. The Korean market has become a hub for cryptocurrency exchange over the past few years.

Recently, the Korean government has slowly embraced Blockchain technology and are looking to support the Blockchain ecosystem in Korea, and as such there will be higher demands for crypto exchanges. Large corporates like Kakao, Korean banks and even the city of Seoul itself are looking to create their own cryptocurrency.

If you are looking to find the best Korean cryptocurrency exchanges, you will need to make sure you find a crypto exchange that works for your location, target currency, payment methods, etc. As such you will need to identify your needs and the type of crypto currency you require.

If you are already an experienced trader in the Korean cryptocurrencies market, then you should already know that you will have the option to select between two types of trades: crypto to crypto or fiat to crypto exchanges. If you lack experience in crypto trading, we suggest sticking to fiat to crypto trading first for ease of use, at least until you purchase enough cryptocurrencies.

Best Korean Cryptocurrency Exchanges In 2023 – Our Top Picks

1. Upbit

Upbit is Korea’s largest cryptocurrency exchange today. ALthough there were some charges against Upbit with making fake accounts to inflate trading volumes to get more customers, Upbit remains the top crypto exchange in Korea with about 1.2 million users and a daily trading volume of over $300 million despite heavy regulations from the Korean government and are a subsidiary of Korean tech giant Kakao.

Trading features

Upbit’s website and exchange platform are currently only available in Korean which may affect visitors from the international audience but google translation is pretty good and can be navigated through reasonably comfortable English.

The main barrier for international users is that in order to trade and register with the exchange, the same process is applied to local Koreans and is pretty geo-specific. KakaoTalk and Kakao Pay accounts are required for verification services so this means that if you do not live in Korea, opening an account with Upbit would require a substantial effort.

It’s mobile and desktop app versions of the exchange bear a close resemblance to KakaoStock which is adapted from the same version for cryptocurrency trading.

Upbit does not offer leveraged cryptocurrencies trading but does offer a high-quality analysis and newsfeed resource. Additionally Upbit only supports fiat currency of Korean Won which deposits can be made in and out of all Korean bank accounts.

Upbit does have a partnership with Bittrex though which allows it to offer a wide range of cryptocurrency coins and tokens with over 100 choices to opt for.

Fees

Upbit does not charge any fees for deposits but the withdrawal fees would vary depending on the type of cryptocurrencies being withdrawn, or in Won to a bank account which are not altogether very high.

Trading fees are similar to other Korean exchanges and are set at 0.25% for takers and makers. Similar to other Korean cryptocurrency exchanges, they are not the cheapest to trade internationally and they are in line with local context.

Security

Being backed by one of South Korea’s internet and Fintech giants of Kakao, cyber security levels protecting UPbit traders are substantial. Their wallets are secured by BitGo which is a widely recognized as the global standard in multi-signature wallets. Additionally, account security is in partnership with Kakao Pay which makes its security levels second only to Samsung Pay.

Pros

- Supports over 100 cryptocurrencies

- Backed by one of South Korea’s biggest technology companies

- Top technology used for trading

- High-level cybersecurity

Cons

- Difficult for non-Koreans to trade on this platform

- Korean Won is the only fiat currency being supported

- Margin trading not offered

2. Coinmama

Coinmama is a cryptocurrency exchange which supports purchase of cryptos in Korea. Coinmama was the first exchange to support payment methods using a credit card and debit card.

Trading Features

Cryptos that are offered include Bitcoin, Bitcoin Cash, Cardano’s ADA, EOS, Ethereum, Ethereum Classic, Litecoin, Qtum Ripple’s XRP and Tezos. These cryptos can be purchased using fiat money via debit card,credit card or via fund transfers.

A significant thing of note is that while traders can buy the most common cryptos using Coinmama, only Bitcoinm can be sold. When buying cryptos, there is no waiting period and everything will be transferred to the stated wallet of the purchaser upon completion of the transaction. In order to store cryptos, Coinmama also offers traders their own crypto wallets.

In Korea you can only use a debit card or credit card as a payment method, which incur a 5% momentum fee

The more crypto you purchase or sell, the less you pay, the more Coinmama has a reward offer. This loyalty program has 3 savings levels and will require a total minimum purchase sum to retain this status for a 90-day period. As below, the breakdown of the loyalty structure is.

Level 1 – Crypto Curious. For new users.

Level 2 – Crypto Enthusiast: When users have reached this level, they are able to save 12.5% on Coinmama fees. Customer support is also more focused for level 2 users compared to level 1. To achieve this level you are required to have a cumulative purchase amount of 5,000USD over a 90-day rolling period to maintain this status.

Level 3 – Crypto Believer. Traders who achieve this level will enjoy savings of about 25% on Coinmama fees and queueless customers support. To qualify however, you are required to have been purchasing cryptos for at least 30-days. To maintain this level you are required to make a cumulative purchase amount of 18,000 USD over a 90-day rolling period. Another option is to make a lifetime purchase amount of 50,000 USD.

Fees

A service called TradeBlock XBX is used by Coinmama to calculate crypto prices. It works by listing the average of established provider prices. Coinmama uses these rates and adds 2 percent (Std Dev) and provides up to 3.9 percent of Coinmama’s commission fees.

Their fees structure is as below.

There is a commission fee of up to 3.9%. This would vary depending on the payment method.

Transactions including a locked crypto rate and instant deliver will incur a 5.0% momentum fee.

Transactions by bank transfer will not incur a momentum fee and no hidden fees.

For selling fees, they will be tiered and are correlated with a user’s loyalty program level. These rates are calculated by the XBX index average +2% (STD dev) with additional Coinmama sales fee of between 0.1% and 0.9%.

Security

This cryptocurrency exchange contains a strong emphasis on protecting its users with a high level of security. Coinmama doesn’t hold any cryptos for users on their exchange and includes a KYC process to safeguard all user accounts and minimize fraud. Any user’s debit/credit card info or bank details also are not stored by Coinmama.

Since Coinmama doesn’t hold any cryptos or store any customer information they do not have a 2-factor authentication but they do recommend that users enable 2-factor authentication on any wallet apps being employed.

Pros

- No additional fees incurred to withdraw coins

- Friendly interface supporting both new and experienced users

- Wide array of cryptocurrencies available to its users.

- Reliable and fast delivery of coins within minutes of purchases.

- User assets are protected from theft.

Cons

- No advanced tool for trading cryptos

- No telephone line or call support available

- Anonymity is removed due to users having to complete a confirmation process to trade cryptos.

3. Kraken

On top of traditional crypto trading, Kraken offers additional services such as margin trading with up to 5x leverage and options for its users to take a short position. It is one of the best cryptocurrency exchanges in the world and is rated the best and safest Bitcoin exchange by independent news media.

Trading Features

Deposits and withdrawals are often made through cryptocurrencies that are traded on this exchange. However they’ll currently only be made via bank or wire transfer and that they don’t allow a debit/credit card to be used. Skrill or Paypal are out of the choice. the explanation that Kraken has such limiting payment options is thanks to the near-instant and risky nature of crypto transactions to forestall fraudulent transactions.

This cryptocurrency exchange offers quite a number of cryptocurrencies which include Ethereum, Bitcoin Cash, Monero, Dash, Litecoin, Ripple, Stellar/Lumens, Ethereum Classic, Augur REP token (REP), ICONOMI, Melon, Zcash, Dogecoin, Tether, Gnosis and EOS.

Fees

Fees and charges can be broken down into making deposits and withdrawals and those incurred in the trading process in Australia

Deposit and option fees

EUR Bank Wire Deposit (10 Euros) – Outside US Only

USD Bank WIre Deposit ($10 USD) – Outside US Only

Withdrawal options and fees

USD Bank Wire Withdrawal ($60USD) – Outside US only

EUR Bank Wire Withdrawal (60 Eur) – Outside US Only

The trading fee is tiered in order that they will drop as trading volumes increase and also vary between the sort of currency that the pair is being traded and also the type of trading ie. Standard, margin-based etc.

The exchange includes a trading fee that’s generally considered to be towards the lower end of the dimensions when it involves exchanging averages.

Security

Kraken considers its security levels to be quite high, however they require higher amounts of private identity confirmation for its account holders as compared to other crypto exchanges. This does largely depend upon whether its users wish to be ready to make transactions in both fiat currencies yet as cryptocurrencies as Kraken is working in line with general banking standards.

Kraken has several tiers of accounts which support the private biometric authentication provided and also the best amount of deposit and withdrawal values are associated with this because of theft and concealment considerations.

A tier 1 account requires users to supply personal information like their full name, date of birth, country of residence and number verification. Tier 1 accounts only allow crypto denominated deposits and withdrawals with a ceiling set at about $2,500 on a daily basis or $20,000 a month.

Tier 3 will allow fiat currency deposits and withdrawals from nationals of all countries meaning providing a sound government-issued ID and proof of residence and address. Tier 4 which is more beneficial for higher volume traders which require the identical quite documents as would be expected by a bank of a regulated financial organization.

Pros

- High digital and financial security

- No geographical restrictions for South Korea

- Varied range of tradeable cryptocurrencies

- Tradeable fiat currencies

- Low fees

Cons

- Improvable customer service response times

- Users can not use a debit/credit card to make payments.

- Fees and withdrawal + Deposit options not too friendly for South Koreans (Only denominated in US

- Dollars and not in KRW)

4. CEX IO

CEX IO gives the options to its traders of selecting different types of accounts which they can then trade cryptocurrencies based on the conditions attached to the account types which match their style.

Trading Features

One thing to note about this cryptocurrency exchange is that trading is usually betweenETH, DASH,XRP, Bitcoin Gold, ZEC, Bitcoin Cash and BTC on one side with several other fiat currencies on the other. Fiat currencies that are supported on CEX IO include the British Pound, US Dollar, Euro, Ruble and many others. As such, only Bitcoin and Ethereum can be bought or sold. For those who wish to engage in online trading of Bitcoin and Ethereum, traders will need to trade the various pairings between Bitcoin and fiat currencies or ethereum and fiat currencies – which can be cumbersome

Depositing or withdrawing funds on CEX IO, use the following channels in Korea:

Credit/Debit cards issued by MasterCard and Visa

Wire transfer using Swift

Fees

Transaction fees (Maker-taker fees)

Deposit/withdrawal fees (Specific to each payment method)

Margin trading fee

Transaction fees are a percentage of the trader’s 30-day trade volume for all pairs. Open fees for margin trades are capped at 0.2% of the invested amount, while rollover fees are capped at 0.01% while no fees are charged to close trade. The below photo should illustrate this clearly.

Security

To ensure that it is a safe place for traders to purchase and sell cryptocurrencies without fear of theft of currency, coins or IDs, this exchange has implemented several security features. As below, security features are:

- Two-Factor Authentication

- Encrypted Data

- PCI DSS Certificate

- SSL Certificate

- Internal AML/KYC policy and procedures

The platform provides an email address for business enquiries at: webmaster@cex.io and also any accounts and cardholder issues at: support@cex.io

Pros

- Relatively low fees

- Cex IO provides few levels of security for clients to trade safely.

- A cold storage wallet protects funds of clients

- Cex.IO is a registered cryptocurrency exchange

- Cex.IO provides more options of cryptocurrencies for exchange and trading

Cons

- Deposit limits are strict for Basic account holders

- Lengthy transaction processing time during peak hours due to number of traders and volume of requests.

5. Bithumb

Bithumb allows the withdrawal and deposit services for XRP,BCH and EOS which they previously didn’t and are specializing in going global with Bithumb Global. Bithumb is currently established in 10 countries worldwide and is looking to produce a secure and reliable withdrawal and deposit service globally.

Trading Features

The Bithumb trading platform is simple to use and easy which has self-explanatory functionalities so it’s ideal for beginner traders.

There are 3 modes of trading options on Bithumb which are easy trade, general trade and at last reserved trade. These different options offer its traders to choose how they require to shop for and sell cryptocurrencies using Bithumb. other than this Bithumb also offers Bitcoin gift vouchers which may be converted into its equivalent of Bitcoin. the bottom denomination for the gift vouchers are 10,000 KRW (approximately $9)

In total you’ll be able to change the subsequent cryptocurrencies on this exchange :BTC, BCH, BTG, DASH, ETH, ETC, LTC, XMR, QTUM, XRP and ZEC

Deposit and withdrawals are only available through KRW points and cryptocurrencies. These KRW points are often purchased through the KB escrow service and are converted on a 1 to 1 basis. Once you create your deposit of KRW into the KB escrow account, the transaction would take about 30 to 45 minutes to be reflected in your Bithumb Wallet.

Fees

There are two varieties of accounts which are a general account and a company account. For a general account Bithumb requires your Name, email and number whereas for a company account they’re going to require your address, name, email and telephone number.

For the fees at Bithumb, they’d charge a 15% basic commission as taker and maker fees with 0%-0.075% for fixed amount coupon transactions

Security

In terms of privacy, thanks to the South Korean government requiring authentication for cryptocurrency trading, no anonymity is obtainable. As such, individuals and firms are required to tolerate Bithumb various verification documents

In terms of security, Bithum uses measures like 2-factor authentication, SSL encryption and 24/7 monitoring of servers to safeguard the protection of the exchange.

Pros

- 24/7 customer support

- Competitive fees

- Multi-lingual support

- User-friendly trading platform

- Wide selection of cryptocurrencies

Cons

- Major fiat currencies not supported

- Does not provide cryptocurrency pairs

- Security of the exchange is in doubt

6. Binance Korea

Binance is one of the best places to buy and sell crypto due to it having the largest trading volume in the world. This cryptocurrency exchange is also one of the fastest platforms in the crypto market today.

Trading features

In Korea, supported cryptocurrencies on Binance include open trading for BTC,ETH, BKRW and will be followed closely with USDT and BUSD. Koreans will easily be able to convert the KRW into BKRW stablecoins to be used for trading

Binance provides their deposit and withdrawal of funds in both crypto and fiat money. You can purchase your cryptocurrencies by debit/credit P2P Trading, cash balances or third party transfers

The cryptocurrency exchange is easy to navigate making it suitable for nove traders and also experienced investors. Binance has multiple trading platforms for this purpose. Users are able to deposit cryptocurrencies from external wallets or deposit fiat currency using the Binance platform. Foreign exchange risk is removed as Binance supports deposits of all major fiat currencies.

Fees

Binance offers a tiered trading fee structure that is based upon a 30-day cumulative trading volume or 24-hour Binance Coin holdings. Traders are categorized into VIP levels, ranging from Level 0 to Level 9.

The trading fees range from 0.1% for maker and taker to 0.02% / 0.04% depending on the VIP level status. Both makers and takers can also receive a 25% discount by using BNB.

Withdrawal fees would depend highly on the type of crypto and you would need to refer to Binance’s guideline tables for each fee.

Security

Binance is one of the many crypto exchanges that deliver a high-level of security to users to protect personal information and user assets. These measures include 2-Factor Authentication, Google authentication, SMS Authentication and E-mail address authentication.

Pros

- User friend platform providing many tutorials and support to familiarise with cryptocurrencies

- Strong emphasis on security

- High trading volume

- Supports deposits and withdrawals of crypto & fiat money

- Binance offers users access to newly launched coins and token using Launchpad

- Can earn interest by saving cryptocurrencies

- Comprehensive, around the clock customer support

Cons

- Lesser privacy due to KYC verification delivering an additional protection for Binance users.

- Novice traders may find the advanced trade platforms more daunting.

7. Coinbase

Coinbase is a US-based bitcoin exchange/broker during which users should buy and sell cryptocurrencies, but are accessible in Korea. Coinbase is accepted as the largest cryptocurrency exchange within the world which is especially because of its easy to use and convenient interface.

Trading Features

Users of this cryptocurrency exchange will have lots of options on which crypto they want to speculate in. They’re able to use a bank account which is the best method used for big and little amounts and takes about 4-5 business days.

An additional method that traders can use for receiving solid funds from cryptocurrency is through Paypal. Coinbase users are able to receive their funds from selling crypto directly into their Paypal account

For purchases, Coinbase allows you to get cryptocurrencies by depositing funds into your Coinbase Account. If you do not wish to use this method, you’ll be able to go for purchases directly using your debit card or credit cards.

Coinbase also imposes a limit for his or her users and this limit increases until their accounts are fully verified. Those with lesser identity information have a limit to what proportion they will trade on the exchange.

Their confirmation process requires lots of private information from their users for confirmation as Coinbase could be a regulated financial services company within the US.

Unlike other cryptocurrency exchanges, Coinbase users can’t be anonymous therefore they’re required to send out their personal information like banking information for direct deposits and also identity confirmation with a government issued ID like drivers license or passport. Be assured however that Coinbase securely stores and protects this information and doesn’t share it with any third parties.

Fees

One positive aspect of Coinbase is that they do not charge any fees for depositing funds into your account but will charge a 1.49% fee for purchasing cryptocurrencies. Coinbase themselves won’t charge a deposit fee but your establishment will which are most typically 3.99% for debit/credit cards and 1.49% for Bank Transfers. As such, Coinbase fees aren’t ideal for cryptocurrency day traders as they’re comparatively beyond many other popular exchanges.

In addition to those fees, traders are required to pay additional network transaction fees and minor fees. If there’s virtual currency transfer involved, users will incur a rate of exchange fee which relies on the spread and incur a conversion fee moreover. All of the fees are shown to the user after they initiate their transactions.

Security

Coinbase could be a crypto exchange that stores most of their user’s deposited cryptocurrency funds in cold storage wallets to confirm the best type of security. The wallets are securely kept in safety deposit boxes and vaults round the world. The crypto exchange also runs over fully encrypted SSI and user wallets are stored using AES-256 encryption.

In short, this crypto exchange is extremely secure and allows other safety features like two-factor authentication, email confirmation and other security measures.

Pros

- Safe and secure cryptocurrency exchange

- Easy and intuitive interface

- Impressive limits and liquidity

Cons

- Fees may be higher than other exchanges

- Limited cryptocurrency choices available

8. Korbit

Korbit is a Korean Company which heavily invests in the cryptocurrency market and performs the following cryptocurrency-related services: Cryptocurrency trading for the local Korean market as well as fiat to cryptocurrency exchange services using the Korean Won (KRW) as the fiat currency of choice.

Trading features

The web-based Korbit platform features separate windows of charting from the actual trade interface which allows users to analyze charts on one window while simultaneously executing trades on another.

Users on Korbit can also gain access to the order book where various market entries made by traders on Korbit are recorded which can be used to gauge market sentiment pointing to either a buy or sell for the cryptocurrency concerned.

These charts come with basic analysis tools but not enough to perform a deep technical analysis. As such, Korbit users may want to resolve to external tools if intense technical analysis with depth is to be performed.

This cryptocurrency exchange allows the following cryptos to be traded: BTC, BTG, BCH, ETH, XRP, LTC, DASH, ZCH, XMR, Augur, Steem and ETC. These digital currencies can be purchased as tokens with Korean Won (KRW) and can be purchased as a form of capital for crypto to crypto trades.

Fees

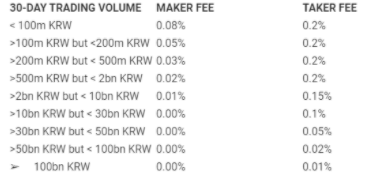

Korbit’s maker and taker trading fees are as below and depend on trading volume over a 30-day period

Security

Korbit is not regulated by the South Korean government although they are contemplating moving in that direction. Korbit also offers 2-factor authentication and there have been no scam complaints.

Pros

- Korbit is widely accepted by its users featuring a bilingual platform in Korean and English

- Provides ability to buy cryptocurrencies with local fiat currency.

- Fees are of moderate value and fee system actually rewards higher volume traders with lower fees

- A clean user interface

Cons

- Not regulated by the Korean government

- Exchange seems to focus too much on the Korean market

- Restricted asset base which means only a few crypto assets can be traded

- Charts feature only a few tools for analysis.

Frequently Asked Questions (FAQ)

Q: Which is the best Cryptocurrency Exchange?

Coinmama and Kraken are the best bitcoin exchanges overall for Koreans

Q: Is cryptocurrency trading legal in South Korea?

Cryptocurrencies are legal in South Korea although subjected to stringent regulations. However they are not considered legal tender.

Q: Which is the Safest Cryptocurrency?

Bitcoin, Ethereum, RIpple, EOS, Bitcoin Cash and Litecoin are all very safe Cryptocurrencies.

Q: Is cryptocurrency taxed in South Korea?

Yes, any cryptocurrency gains in the country are subject to a 20% tax for any amount of $2,000 or 2.5 million win

Q: Can I Buy an amount less than 1 Bitcoin?

Yes. Every single BTC is divisible to 0.00000001 BTC, so it is possible to buy a small fraction of a coin with its value apportioned appropriately.

Q: Can I store my Bitcoin on an exchange?

While some exchanges do offer storage services for your cryptocurrencies, it is generally not recommended as they are a popular target for hackers and you lose control of your private keys. As such the best way to store your coins are on a secure, private wallet – which some exchanges offer as well.

With over 10 years of experience working as a financial analyst, Eric is highly aware of the potential of cryptocurrency, particularly Bitcoin, and the impact it will bring towards the global economy. He is committed to share everything he knows about crypto here at Crypto Digest News.